Selling your business can be time-consuming and unpredictable. Knowing what to expect can help get your deal successfully to closing.

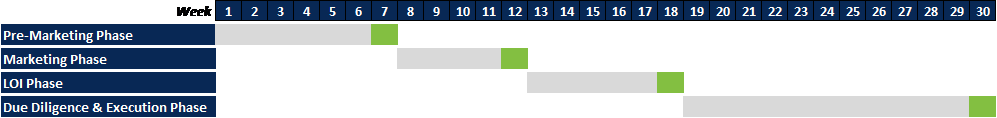

The average sell-side M&A process takes about six to nine months. Factors such as buyer and seller responsiveness can prolong this timeline. The process can be broken down into four main phases:

- Pre-Marketing Phase

- Marketing Phase

- Letter of Intent (LOI) Phase

- Due Diligence Phase

The graph below illustrates this general M&A timeline.

Note: The timeline may vary based on various factors, including availability of information, seller responsiveness, and overall buyer response to the deal. Lutz M&A will lead/be involved throughout the process.

Pre-Marketing Phase

Gather Information

During the pre-marketing phase, we gather as much information as possible on the company through our internal due diligence to represent the seller effectively. This includes looking into the company’s history, products and services, customer base, vendors, management structure, sales strategy, financial historical performance, etc. Internal due diligence is critical for putting together strong marketing materials and financial models and being able to tell and sell the company’s story.

List Potential Buyers

Additionally, during the pre-marketing phase, Lutz M&A typically takes the lead in putting together the list of potential buyers. The buyer universe can vary based on the seller’s preference. It can be comprised of solely strategic or financial buyers or both. The fit of each buyer is analyzed internally first and then discussed with the client.

Create Marketing Materials

Marketing materials represent the first formal introduction of the seller to prospective buyers. They are essential for sparking buyer interest and creating a favorable first impression. A robust set of M&A materials can and will substantially impact the success of an M&A sale. The marketing materials package typically includes:

- Investment Teaser - an anonymous one-page summary of the company up for sale. It typically includes a short business description, investment highlights, and a summary of financial information. The teaser is designed to inform buyers and generate sufficient interest so that they want to know more about the seller.

- NDA - a non-disclosure agreement is provided with the investment teaser and exchanged between the buyer and seller if the prospective buyer is interested in learning more about the company after looking at the teaser.

- Confidential Information Memorandum (CIM) – represents the primary marketing document for the seller in a sale process. It describes the business in greater detail, revealing specifics and providing key information that a buyer needs to fully assess the opportunity.

- Process Letter - provides information on the M&A auction process, such as timeline and contact info for all future communication. It also outlines any terms the bidders must include in their initial indication of interest (IOI).

We understand that every business has a unique story to tell, and we want to convey that as effectively as possible. The process of preparing marketing materials helps us learn about the company and gives us the knowledge to field questions and run the deal process with minimal involvement from our client.

Marketing Phase

Buyer Outreach

During the marketing phase, we contact the companies identified as potential buyers. We do this via direct outreach to specific buyers and keep it strictly confidential. We do not post active engagements on the Lutz website but proactively engage with potential suitors. If a buyer wishes to view the CIM, we require them to sign a non-disclosure agreement (NDA).

Submit Indication of Interest

Upon signing the NDA, buyers are informed of deal milestone dates to target a timely close through a process letter. If interested in pursuing the deal further, buyers will submit an indication of interest (IOI), essentially a preliminary non-binding offer. We will work with our clients to evaluate each IOI and create a list of the top candidates, who will then be invited to move on to the next phase in the process. Lutz M&A facilitates all negotiations during the process and effectively communicates all the client’s conditions to the respective buyers.

Letter of Intent (LOI) Phase

Site Visits & Management Meetings

Buyers invited to move on to the LOI phase will gain access to more information. This may include more detailed financial items not previously provided and further calls/discussions with Lutz M&A. Additionally, buyers are invited to meet our client’s management team in person. This meeting typically lasts several hours, allowing the parties to get better acquainted and further assess a potential partnership. Lutz M&A assists the client with any preparation needed prior to the meeting and handles any preliminary diligence requests from the buyer throughout the LOI phase.

Submit Letter of Intent

Shortly after the management meetings and site visits, buyers with continued interest in the company are asked to submit a Letter of Intent. While the LOI is not a legally binding document, it does lay out key deal parameters to come later in the purchase agreement. Lutz M&A and the client's legal counsel will work closely with the client to assess and negotiate the LOIs. Following negotiations, a winning buyer is selected, and the due diligence process begins.

Due Diligence Phase

Cover Diligence Requests

Upon the start of the due diligence phase, the buyer will distribute the diligence requests to Lutz M&A. Typically; diligence requests can cover various areas such as financial, legal, HR, environmental, IT, insurance, tax, property, and much more. The diligence process can be extensive, and Lutz M&A works to minimize the client’s workload throughout the process.

Deal Negotiation

A virtual data room (VDR) is set up, and Lutz M&A handles populating the VDR and communicating with the buyer. Lutz M&A provides frequent updates to the client and assists with any questions, concerns, and potential hiccups throughout the process. In addition, Lutz M&A evaluates tax implications and the deal structure and assists the legal team with preparing the legal documents, including the purchase agreement. They also negotiate final deal terms while acting as the quarterback to keep the deal moving toward closing. Lutz M&A is focused on putting the client’s needs first and is dedicated to providing a smooth process with a successful closing to the best of our abilities. The due diligence phase often takes 90 days or longer.

M&A Transaction Services That Help

In summary, the M&A process can be lengthy and complex. Lutz M&A can help you navigate to a successful closing. Our credentialed professionals provide senior-level attention and expert advice every step of the way. As one of the largest M&A firms in the Midwest, we utilize our extensive experience and confidentiality to help keep your deal on track and running smoothly. If you have any questions or want to learn more, please contact us.

- Learner, Ideation, Achiever, Responsibility, Relator

Dani Sherrets

Dani Sherrets, M&A Manager, began her career in 2014. She has built extensive expertise in mergers and acquisitions and business valuations.

Specializing in sell-side advisory services, Dani leads deal processes from the initial pitch to final execution. She provides comprehensive transaction support across a range of industries, including retail, manufacturing, and transportation. She thrives in the fast-paced nature of M&A and takes pride in guiding clients toward their strategic objectives while mentoring junior team members.

Dani lives in Omaha, NE, with her husband Bob, children Katrina and Sebastian, dog Princess Leia, and their cat, Spock. Outside the office, she enjoys traveling the world and immersing herself in different cultures.

Recent News & Insights

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

How Stay Interviews Help Retain High Performers

The Importance of Hiring an M&A Team

Treasury Management: Strategies to Improve Financial Stability & Growth

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)