Strategic Buyers

Strategic buyers are companies that operate in the same industry, or perhaps a related or adjacent sector. These buyers would look to acquire for various reasons such as: to gain market share, enhance growth opportunities, expand or extend product lines, gain scale, and/or improve efficiencies. Further, strategic buyers would look to obtain assets that include skilled people, technology, processes, customers, and suppliers. Strategic buyers tend to pay higher multiples, because they can fold an existing company into its operations and typically obtain immediate cost savings/synergies. Also, these buyers typically pay higher prices as they view the acquisition as being strategically important or even critical.Private Equity Buyers

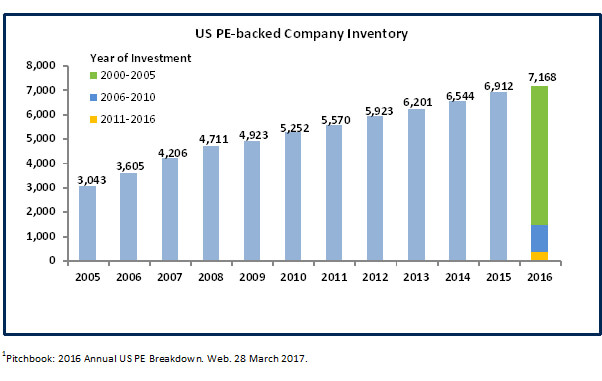

Private equity (“PE”) firms will look at acquisitions strictly in terms of returns on investor capital. They may take a harder look at ways they can improve operations, cut costs, professionalize the business, and find new growth avenues in order to boost company performance and, as a result, drive better investment returns. It is important to note that PE firms are “fund-driven” which means they are held accountable for investment performance by their outside investors (usually institutions and high-net worth individuals). Because they are “fund-driven” and focused on returns, PE firms may have a shorter time-horizon than strategic buyers. The reason for this is that funds usually have a specific life (roughly, 5 years), after which capital must be returned to investors. As such, PE firms seek to liquidate investments through various methods such as IPO, recapitalization, and/or merger and acquisition. PE firms are very active buyers in the middle market.

Hybrid Buyers

The primary goal of hybrid buyers is to achieve a high return on investment, generally over a longer time horizon than PE firms. There are two main types of hybrid buyers: high-net worth individuals and family offices. Wealthy individuals may have a whole host of goals and motivations. They may look to increase the value of and sell a company within a relatively short period, or they may buy and hold (and run) a company for an indefinite period. It would be important to explore and discuss post-deal plans with each such buyer, to better understand what the future may hold. Family offices are essentially wealthy families that have established a private equity-type function in order to buy companies. The difference between family offices and PE firms is that most family offices tend to not be fund-driven and usually do not raise external capital. As such, they tend to be more “buy-and-hold” focused and invest in companies over a longer period of time. Family office involvement in operations is usually minimal and likely only at the board level. As sellers look to transition out of their business, we advise them to become familiar with the wide range of potential buyers. This exercise will allow sellers to make informed decisions about what they seek in a new owner and how that owner may operate the business post-transaction.If you have any questions, please reach out to our Lutz M&A team.

- Analytical, Achiever, Context, Competition, Learner

Ryan McGregor

Ryan McGregor, Consulting Director at Lutz M&A, began his career in 2012. With a diverse background in banking and finance, he has developed extensive expertise in business valuation, mergers and acquisitions, and exit planning.

Specializing in succession planning and valuations, Ryan focuses on helping clients across various industries including agribusiness, construction, healthcare, and manufacturing. He conducts in-depth market analysis and prepares comprehensive valuation reports for purposes ranging from gift and estate planning to Small Business Administration (SBA) qualified opinions. Ryan values building relationships with clients and finds satisfaction in seeing them successfully transition their businesses through well-crafted succession plans.

At Lutz, Ryan has demonstrated his commitment to professional expertise, earning multiple designations including Certified Exit Planning Advisor (CEPA), Certified Valuation Analyst (CVA), and Certified Mergers & Acquisition Advisor (CM&AA). His analytical approach and drive for continuous learning enable him to provide innovative solutions tailored to each client's unique needs.

Ryan lives in Omaha, NE, with his wife Beth and their three children. He enjoys spending time with his large family and is an avid golfer and sports fan.

Recent News & Insights

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

How Stay Interviews Help Retain High Performers

The Importance of Hiring an M&A Team

Treasury Management: Strategies to Improve Financial Stability & Growth

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)