Net Working Capital: What is it and How is it Used?

A commonly misunderstood topic in M&A transactions is the concept of net working capital (NWC). This is recognized as a predetermined amount of capital that is included in the purchase price in a business sale transaction. Understanding what NWC encompasses and how this amount is calculated is an important step in the M&A process.

What is Net Working Capital?

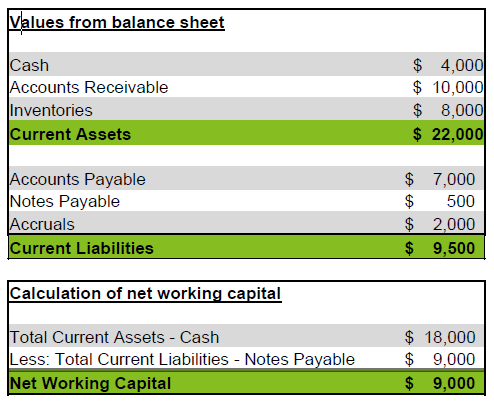

Net Working Capital is a measure of operating liquidity available to a business at a given point in time. Major NWC accounts include accounts receivables, inventory and accounts payable. In short, it can be calculated as your business’s current assets (less cash) minus its current liabilities. Here is an example calculation for NWC:

Net Working Capital in Business Transactions

In most transactions, NWC stays with the company being acquired as it is considered a necessary operating asset of the business. However, by monthly tracking of collections, payments, and inventory levels, sellers of a business can minimize the amount of money locked up in NWC in order to retain more cash when the business sells.

For example, if the selling company has historically paid its vendors in 15 days even though they have 30 day payment terms, the company could adjust their payment timing to increase cash on hand and reduce NWC. This change would need to occur well before starting an M&A process (more than a year).

The reason for needed to work on your NWC well before embarking on an M&A process is that most buyers will require a NWC peg based on the company’s historical averages.

A problem with relying on historical results is that the information can often be skewed. Seasonality, peaks and troughs, can often affect the validity of a company’s historical results of NWC. To get a more accurate estimate, buyers will establish “trends” by analyzing a company’s historical NWC over a 12-18 month period.

How Lutz M&A Can Help

Overall, not understanding and addressing net working capital issues earlier in the M&A process could have a significant impact on the business transaction and the ultimate amount of cash the seller realizes from the transaction. If you have any questions regarding net working capital, please contact us or learn more about our Lutz M&A services.

- Activator, Achiever, Individualization, Analytical, Focus

Bill Kenedy

Bill Kenedy, Consulting & M&A Shareholder, began his career in 1990. He established Lutz's M&A practice in 2015 and has led its growth since then while serving on both the firm's board of directors and the Lutz Financial board.

Specializing in mergers and acquisitions, Bill guides business owners through critical transition decisions. He provides comprehensive exit planning and transaction services, with specialized expertise in the construction industry. Bill values helping owners achieve optimal outcomes by developing strategic solutions tailored to their unique situations.

At Lutz, Bill says it straight, offering candid guidance that helps owners make informed decisions about their businesses' futures. His direct approach to setting realistic expectations, combined with his focused drive to get deals done, has made him the go-to advisor for business transitions. As a Certified Exit Planning Advisor (CEPA), Certified Public Accountant (CPA), and Accredited Business Valuator (ABV), Bill brings technical expertise to every transaction. Under his leadership, the M&A practice has grown from a concept to a cornerstone of Lutz's service offerings.

Bill lives in Elkhorn, NE, with his wife, Angela. Outside the office, he spends time fishing, hunting, and following various sports teams.

Recent News & Insights

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

How Stay Interviews Help Retain High Performers

The Importance of Hiring an M&A Team

Treasury Management: Strategies to Improve Financial Stability & Growth

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)