Fall is in the air, and kids are back to school. Whether they are attending physically or virtually this year, the cost to provide education is still present for many. To help, grandparents have the option to support their grandchildren with schooling expenses by setting up an education fund. How is this done? In this blog we will discuss the tools grandparents can utilize to provide financial support to their grandchildren for education purposes.

What does college cost these days?

Choosing a college is a big decision, and it shouldn't be taken lightly, especially with the costs that seem to be rising every year. Let me break it down for you. In the state of Nebraska, the tuition, room and board, and books at Creighton for a student that is age eighteen and entering their first year of college is $53,874. The same scenario, but going to the University of Nebraska-Lincoln, is $22,240.

Talk about it

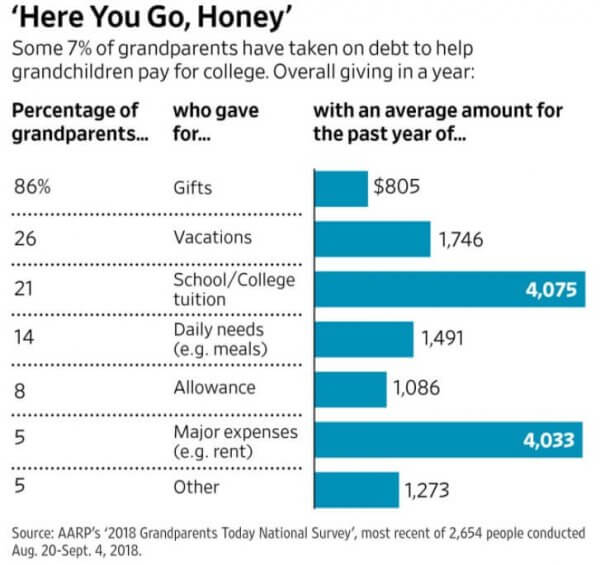

Today, we encounter many grandparents contributing to their grandchildren's education (see chart below). The good news is that there are several ways that grandparents can assist. It is crucial that grandparents, parents and grandchildren have a conversation about their plan to pay for college. The reason is that we see a broad perspective on how families want to deal with college costs. Some adults want to pay the full cost because they don’t want it to hinder the student’s experience. Others want their child to have some skin in the game by having them pay or borrow in order to learn life lessons. Then, we see the opposite end of the spectrum of student’s taking out loans and working to pay for tuition completely on their own. The reason everyone needs to be on the same page is that a student’s opportunity for financial aid could be lessened if not planned for properly, or they could have a negative tax impact on the child or parent.

Fill out the freebie

Every student is entitled to fill out the FAFSA (Free Application for Federal Student Aid). The 2022 FAFSA becomes available for students to fill out on October 1, 2020 and is due by June 30, 2022. The sooner the application is completed and turned in, the better the chances are for qualifying for the most grant and scholarship aid. Keep in mind there is a 2-year lookback period for income reported on the FAFSA, which means that if you are filling out the FAFSA for the 2020 school year, your 2018 income will be considered. Why is that part important? This is useful information for grandparents wanting to open a 529 for their grandkids, and not having it included in their FAFSA calculation. To avoid it from being included, grandparents should not allow grandchildren to tap into their 529 plans until after their sophomore year FAFSA has been filed.

Source: NerdWallet authors Teddy Nykiel and Anna Helhoski

What are the tools that I can use as a grandparent?

UTMA (Uniform Transfers to Minors Act) account

Grandparents can open a UTMA account for the benefit of their grandchild. The account qualifies for the yearly gift tax exemption of up to $15,000 per individual and $30,000 for a couple. The grandparents will have control over the account until the minor reaches age of majority. A UTMA is an includable asset by the student on the FAFSA rather than the parent when calculating financial aid. All money contributed to the UTMA is on an after-tax basis, while earnings generated become taxable to the minor.

529 Plans

Every state offers its own 529 plan or plans. 529 plans are useful planning techniques because they are tax-deferred tools that allow gifts by grandparents up to the annual exclusion or five-year forwarding exclusion amount. They allow for tax-free distributions when used for a qualified education expense such as tuition, books, room and board, etc. In the state of Nebraska, the NEST 529 plan offers a state tax deduction of up to $10,000. If a grandchild gets through college not using all the funds, the grandparent can change the beneficiary’s unused funds to another grandchild for their benefit. However, be very careful about this! When a child begins taking distributions from the 529 plan, the income is counted as income to the student on the FAFSA, which is much more heavily weighted than parental income in the FAFSA formula. The key takeaway here is to wait until after the FAFSA has been filed for the student’s sophomore year to start taking distributions.

Check written directly to the college

Grandparents can write a check directly to a financial institution for tuition, and tuition only, without having tax consequences. The check can be written for any amount and still have the grandparent be eligible to provide the grandchild with a $15,000 gift in that same year and not have to file a gift tax return. The drawback of this is that grandparents can’t claim any tax deduction for college tuition paid on a child’s behalf. Grandparents should be aware that this payment type could also disqualify a student for financial aid need.

Plan accordingly and stick to a plan

You helped your grandchild to get a quality education by saving in a vehicle that will take some financial stress away. You took the necessary steps to put a plan in place. It is inevitably subject to change based on scholarships, length of schooling, transferring schools, etc., but one of the biggest things that we have learned this year is to get back in the batter’s box when thrown a curveball. If you are reading this and don’t have a plan in place, well, you have already taken the first step in the right direction. Have a conversation with your family, talk to college counselors and your financial advisors, and distribute your assets accordingly to give both you and your grandchild the most significant benefit. If you have any questions, please contact us.

Recent News & Insights

Update: Tax Highlights of “The One, Big, Beautiful Bill”

From Seed to Scale: Tax & Operational Strategies for AgTech Startups

Case Study: A Smarter 401(k) Strategy for a Busy Doctor's Office

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)