Like many other industries, medical practices follow a specific format for their financial statements. Our last blog, “Understanding Healthcare Accounting: How Income and Expenses Affect Growth,” outlined the different components of healthcare accounting. Medical Group Management Association (MGMA©) formatted financial statements allow a medical practice to track income and expenses by provider, compare to industry benchmarks, calculate physician compensation, and analyze information for informed decision making. This blog post will discuss the components and benefits of MGMA© formatted financial statements.

1. MGMA Chart of Accounts & Financial Statement Example

There is a standard chart of accounts used in MGMA© formatted financials. It is broken out into the following categories:

- Revenue

- Cost of Employee Labor

- Clinic Expense

- Facilities Expense

- General & Administrative Expense

- Physician Assistant/NP

- Physician Expenses

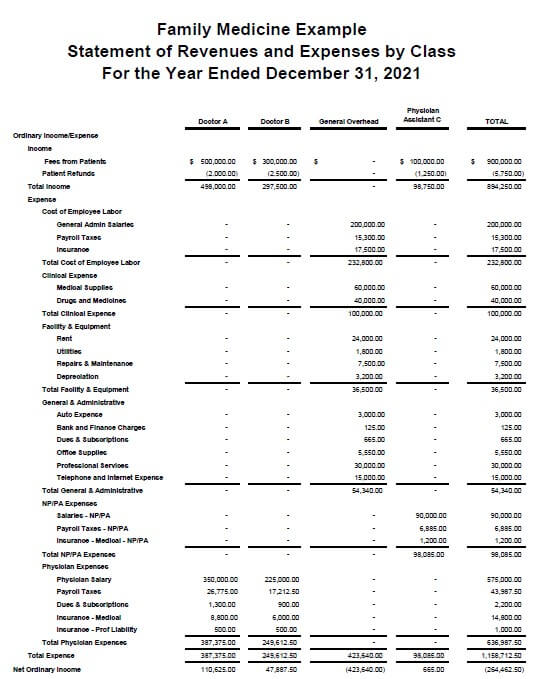

In addition, MGMA© formatted financials track income and expenses by “class.” The “class” could be providers or locations – depending on what information is best for the medical practice. Below is a basic example of what MGMA© formatted financials would like for a family medicine practice with two physicians and one physician assistant.

From this example – we can tell that Doctor A is producing much more revenue for the practice than Doctor B. We can see each provider’s net income from their allocated revenue and expenses. However, keep in mind that this does not include any of the “general overhead” expenses.

2. MGMA © Benchmarking

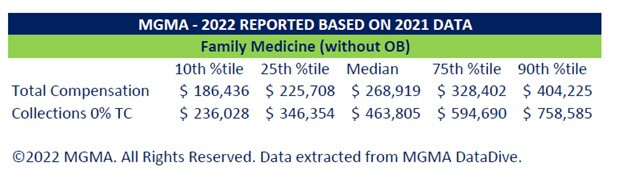

If a medical practice adheres to the standard MGMA © chart of accounts and MGMA© financial statement format, it can easily compare to nationwide benchmarks. MGMA© publishes yearly survey data that displays key metrics by filters such as specialty, geographic section, demographic classification, and organization ownership (physician vs. hospital owned). This data is presented by 10th, 25th median, 75th, and 90th percentiles.

For example, below are two benchmarks for a family medicine (without OB) practice from MGMA©. This data does not have any additional filters.

This information can be compared to our family medicine practice Above:

- Doctor A

- Total compensation (Total Physician Expenses) is slightly above the 75th percentile.

- Collections are between median and the 75th percentile.

- Doctor A’s total compensation and collections are fairly consistent according to MGMA©

- Doctor B

- Total compensation (Total Physician Expenses) is slightly above the 75th percentile.

- Collections are between 10th percentile and 25th percentile.

- Doctor B’s total compensation is too high based on the collections according to MGMA©

Our family medicine practice could be further analyzed. Below are a few examples of additional metrics that could be analyzed:

- Operating Expense % of Total Revenue

- Total Encounters

- Work RVU’s

- Many More!

3. Other Benefits

Besides the ability to easily benchmark, a medical practice that has MGMA© formatted financials can easily:

- Calculate physician bonuses if revenue and expenses are directly allocated in the calculation

- Discuss compensation changes

- Identify areas for improvement

- Make informed decisions

- Identify trends and outliers

- Budget

Partner with Lutz for Your Healthcare Accounting Needs!

At Lutz, we have a team that specializes in healthcare accounting and consulting. We can help you set up MGMA© formatted financial statements, benchmark to MGMA© national data, and discuss physician compensation structure. Our team of experts uses cutting-edge technology to help you stay on top of your practice. Contact us today to learn more about how we can help you grow your practice. You can also visit our website to understand our healthcare services or read related articles.

MGMA©: https://mgma.com/

Recent News & Insights

Recruiting medical talent? Know the Tax Implications of Modern Compensation Packages

How Stay Interviews Help Retain High Performers

The Importance of Hiring an M&A Team

Treasury Management: Strategies to Improve Financial Stability & Growth

.jpg?width=300&height=175&name=Mega%20Menu%20Image%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(2)%20(1).jpg)

%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg?width=300&height=175&name=Untitled%20design%20(6)%20(1)-Mar-08-2024-09-27-14-7268-PM.jpg)

%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg?width=300&height=175&name=Untitled%20design%20(3)%20(1)-Mar-08-2024-09-11-30-0067-PM.jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(3)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(4)%20(1).jpg)

%20(1).jpg?width=300&height=175&name=Mega%20Menu%20Image%20(5)%20(1).jpg)

-Mar-08-2024-08-50-35-9527-PM.png?width=300&height=175&name=Untitled%20design%20(1)-Mar-08-2024-08-50-35-9527-PM.png)

.jpg)